The Magnificent Seven’s impact on the S&P 500

31 October 2025

Market Concentration and the “Magnificent Seven”

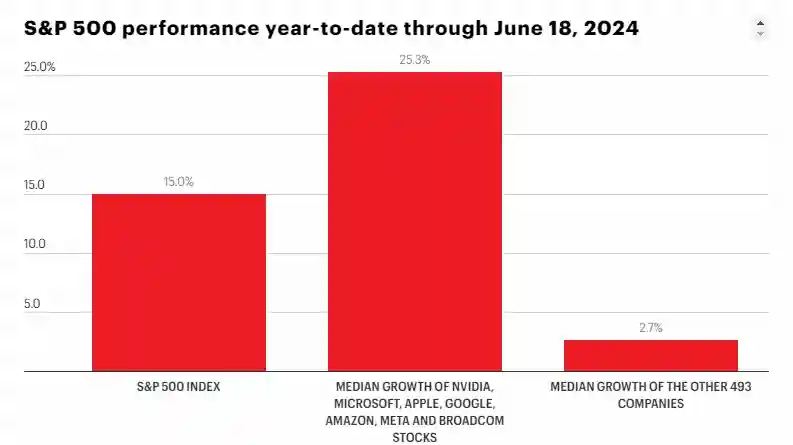

The S&P 500, a key barometer of the US stock market, is currently exhibiting a remarkable degree of market concentration. The top 10 stocks within the index now account for 33% of its total market value, significantly surpassing the 27% concentration observed at the height of the tech bubble in 2000. This trend has been driven largely by the "Magnificent Seven": Microsoft, Apple, Nvidia, Alphabet, Amazon, Meta, and Tesla. These stocks have collectively amassed substantial market capitalisation, leading to a skew in the index's performance and valuation metrics.

Dominance of Tech Giants

The influence of these tech giants is particularly noteworthy. Nvidia alone has been responsible for 34.5% of the S&P 500’s gains in 2024, highlighting the critical role a company can play in driving market performance. The combined market cap gains of Microsoft, Apple, Nvidia, Alphabet, Amazon, and Meta amounted to $1.3 trillion in May 2024, accounting for 76% of the S&P 500’s total gains for the month. This underscores the outsized impact of a few major players on the overall index.

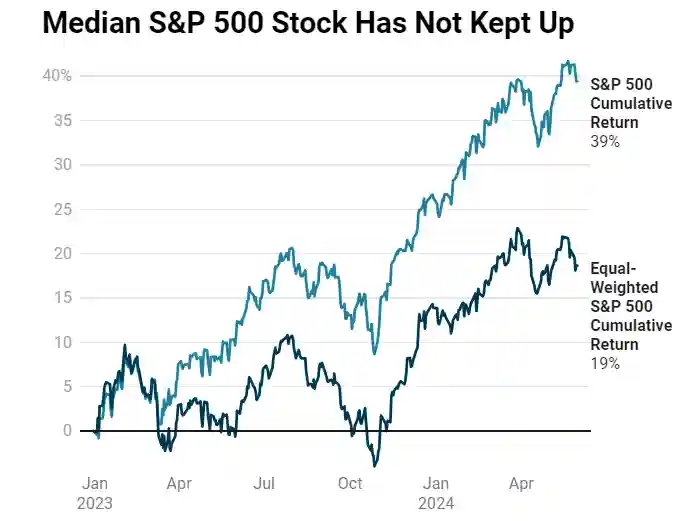

Performance Comparison: S&P 500 vs. Equal-Weighted S&P 500

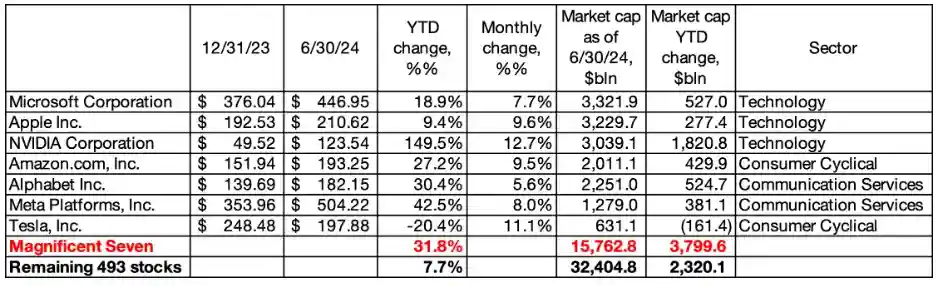

The performance divergence between the S&P 500 and its equal-weighted counterpart underscores the market concentration issue. While the S&P 500 posted a nearly 3.5% gain in June 2024, by contrast the equal-weighted S&P 500 was down 0.7% in the month. This disparity has been consistent throughout 2024, with the traditional S&P 500 significantly outperforming the equal-weighted index, 20.6% and 8% respectively, through to June. Notably, within the S&P 500, the year-to-date change for the "Magnificent Seven" stocks is 31.8%, compared to a 7.7% YTD change for the remaining 493 stocks as of June 2024.

Implications for Investors?

While the dominance of the "Magnificent Seven" has propelled the market to new heights, it also introduces potential risks. Investors should be mindful of the implications of this concentration and consider diversifying their portfolios to mitigate potential downturns in these influential stocks. As history has shown, the market dynamics can shift, potentially leading to a broader dispersion of gains across the S&P 500, which investors can benefit from. One way is to have direct exposure to the S&P Equally Weighted Index. Investors could also look into structures that can provide them an opportunity to participate on the upside of these megacap stocks and the broader market, but can also provide some downside protection in case the recent run-up in these names were to reverse. Of course, investors should ensure that at all times the portfolios should be well diversified and in line with their risk profiles.

Discover Similar Insights

Every day, our experts deliver fresh insights on trending topics,

sectors and markets to help you stay ahead of the curve.

I Inherited a windfall - it was a blessing and a curse

"If you don't do the personal work of really acknowledging your privilege, understanding your responsibility to redistribute away resources and your power - and so sometimes acknowledging the fact that you're not the best person to make those investment or philanthropic decisions - then, of course, the whole thing doesn't work." “Unfortunately for some other of my relatives who received the money, ended up corrupting their lifestyle and also their mental health, so it wasn't good for them, and that money was wasted." Some $90 trillion (£69 trillion) will be transferred to American millennials

Dividend Stocks – potential to Outshine Bonds in a Low Interest Rate Environment

Introduction As we approach September 2024, a significant shift in the financial landscape looms large. The Federal Reserve, having spent much of the past few y…

Market Correction – What is Ahead for Investors!

Introduction Since November 2023 US stocks have rallied almost 30% until the recent drawdown that started in early April. The S&P 500 was down as much as 5.5% i…

Hotel Tycoon Takes £6m Life Insurance to Shield Business from Inheritance Tax Hike

‘I’m insuring my life for £6m to protect family from IHT raid’ More business owners are seeking policies to protect their assets from ‘death tax’ for after they…